KS ST-28D 2008-2025 free printable template

Show details

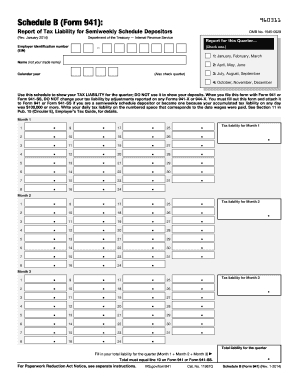

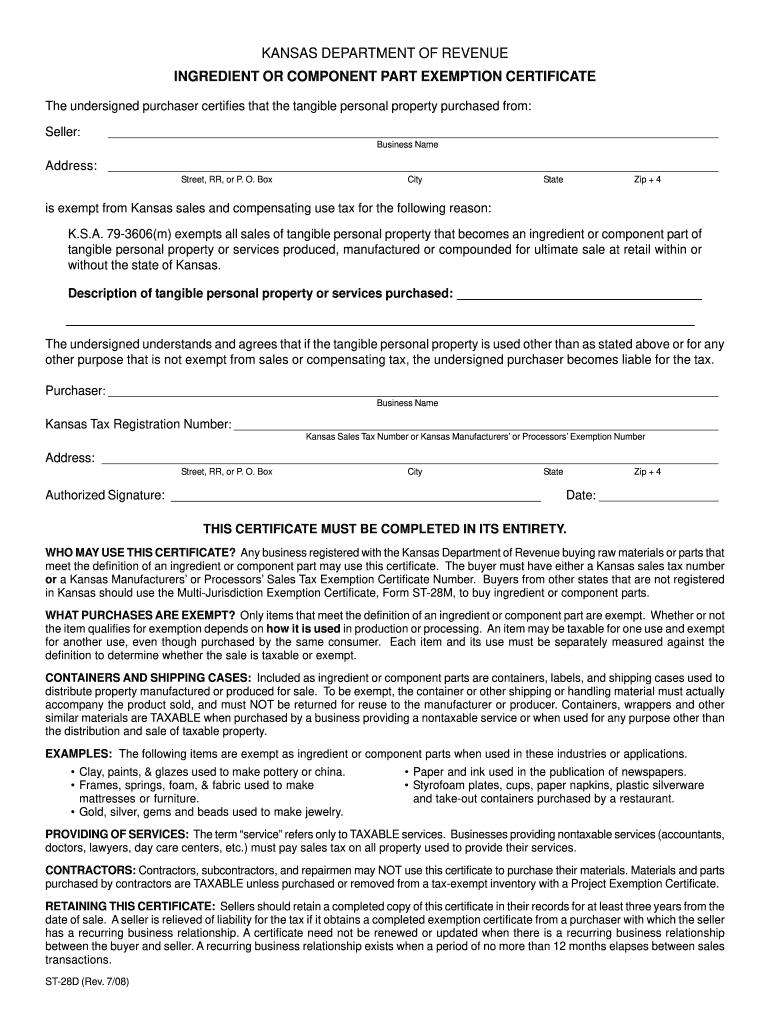

KANSAS DEPARTMENT OF REVENUE INGREDIENT OR COMPONENT PART EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property purchased from: Seller: Business Name Address:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ks st28d form

Edit your kansas component form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st28d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 28d online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit reseller permit kansas form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bill of sale for car in kansas form

How to fill out KS ST-28D

01

Start by downloading the KS ST-28D form from the official Kansas Department of Revenue website or obtain a paper form.

02

Fill in your personal information, including your name, address, and contact details at the top of the form.

03

Indicate the type of exemption you are requesting by checking the appropriate box.

04

Provide details about the property or transaction for which you are seeking an exemption.

05

Include any additional documentation or proof required based on the type of exemption.

06

Review your form for accuracy and completeness before submission.

07

Submit the form to the appropriate agency as instructed, either by mail or electronically if applicable.

Who needs KS ST-28D?

01

Individuals or businesses that are applying for a specific tax exemption in the state of Kansas.

02

Property owners seeking exemptions for specific types of properties or transactions.

03

Non-profit organizations that qualify for tax-exempt status in Kansas.

Fill

form 28d

: Try Risk Free

People Also Ask about

How do I apply for property tax exemption in Kansas?

The applicant must fill out the TX Application Form completely and thoroughly and must provide all required Additions and other documentary support. The applicant's statement of facts must be provided by way of affidavit. Unsworn statements cannot form a basis in fact for a property tax exemption.

How do I become a registered reseller in Kansas?

To get a resale certificate in Kansas, you will need to fill out the Kansas Resale Exemption Certificate ST-28A, the Kansas Multi-Jurisdiction Exemption Certificate ST-28M, or the Kansas Streamlined Sales and Use Tax Agreement PR-78SSTA.

How do I get a resale license in Kansas?

There are two ways to register for a Kansas sales tax permit, either by paper application or via the online website. We recommend submitting the application via the online website as it will generally be processed faster and you will receive confirmation upon submission.

How do I get a copy of my Kansas sales tax certificate?

Obtain a State of Kansas Tax Clearance Request Online - Click here to complete an application through our secure website. Return to the website the following day to retrieve your "Certificate of Tax Clearance". Applications must be submitted by 5pm Monday – Friday in order to be available the following business day.

What items are exempt from sales tax in Kansas for resale?

Only goods or merchandise intended for resale (inventory) are exempt. Tools, equipment, fixtures, supplies, and other items purchased for business or personal use are TAXABLE since the buyer is the final consumer of the property.

How much does a reseller permit cost in Kansas?

There is no fee for a Kansas seller's permit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KS ST-28D directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your KS ST-28D and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit KS ST-28D on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing KS ST-28D right away.

How do I fill out KS ST-28D on an Android device?

Use the pdfFiller mobile app and complete your KS ST-28D and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is KS ST-28D?

KS ST-28D is a tax form used in Kansas for reporting specific sales tax exemptions or refunds.

Who is required to file KS ST-28D?

Any individual or business that wishes to claim a sales tax exemption or refund must file KS ST-28D.

How to fill out KS ST-28D?

To fill out KS ST-28D, you need to provide relevant business information, details about the items purchased, and the reason for claiming the exemption or refund.

What is the purpose of KS ST-28D?

The purpose of KS ST-28D is to document and process requests for sales tax exemptions or refunds within the state of Kansas.

What information must be reported on KS ST-28D?

The information that must be reported on KS ST-28D includes the claimant's name, address, type of exemption, invoice details, and the total amount of sales tax being claimed for a refund.

Fill out your KS ST-28D online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS ST-28d is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.